Have you ever heard that the UBA Prepaid Card is the smartest way to transact Forex? I guess no.

Well, don’t worry as you will learn everything you need to know about the UBA prepaid card, the types, why you need it, and how to use it as an online hustler.

Before we focus on UBA, let’s see what prepared cards are.

What are Prepaid Cards?

Prepaid cards are cards (both physical or virtual) funded directly by cardholders (you) which nullifies the need for you to have a formal bank account.

That is to say, it is a multifunctional card that provides customers with easy access to cash through ATMs, online shopping, and purchases at merchant outlets as well as web transactions.

Coming down to the Uba Africard.

What is UBA Prepaid Card?

In summary, the UBA Prepaid Card is a pre-funded and re-loadable visa card that can be used to pay bills and make purchases anywhere in the world.

The card is not restricted to the CBN $20 card spend a month.

The prepared card is the best card for those who want to start blogging and pay for web hosting services, fund their Facebook ads manager account, shop online, and very importantly, pay for goods/services on 3D secure websites.

More so, the card helps you in budgeting and controlling your spending, paying for online subscription services, and digital ads.

The UBA Visa prepared card is available in Nigeria for all Nigerians (both UBA and Non-UBA customers), and other African countries such as Benin Republic, Burkina Faso, Chad, Congo DRC, Kenya, Liberia, Mali, Mozambique, Senegal, Tanzania, Uganda, Zambia.

Types of UBA Prepaid Cards

There are 2 popular types of Uba Prepaid cards.

- Naira Denominated Prepaid Card. This card is in Naira, can only be funded in Naira, and it has a limitation of about N50,000 spend a month.

- Dollar Denominated Prepaid Card. This card is in Dollars, can only be funded in dollars, conversion exchange rates are in dollars, has a card portal, and the international spend limit is $10,000 per month.

Read Also – UBA Dollar Prepaid Card: How to Send & Withdraw from Card to Bank

Pls, note that the Dollar Denominated Prepaid Card has a dollar $$ sign on top of it and it is the best type of prepared card. See the reasons below.

UBA Naira Prepaid Card vs UBA Dollar Prepaid Card

| UBA Naira Prepaid Card | UBA Dollar Prepaid Card |

| It is Naira denominated. | It is Dollar denominated. |

| It has a limit of about N50,000 per month. | The transaction limit spends is up to $10,000 per month. |

| It may not be accepted on some international online platforms. | It is accepted on POS, ATM, or Online. |

| You can link to PayPal for Naira at a local bank rate of about N418/$ | You can link to PayPal for Dollars for a higher exchange rate. |

| – | You can transfer funds from one cardholder to another. |

| – | It has a card service portal |

| It has a client ID | It has a client ID. |

Requirements To Get the UBA Prepaid Card

#1. Agree to terms – by using your UBA PREPAID CARD, you unconditionally agree to be bound by the laws, rules, and regulations, and with UBA permission only if they allow you to do so.

#2. Must be 18 years – you must be at least 18 years old to apply for a prepaid card.

#3. Identity & Address – Proof of identity and address is required to apply for checks on you electronically.

#4. Valid Phone Number/Email – you will provide a valid telephone number/or e-mail at the point of applying for a Prepaid Card.

#5. Card Activation Fees – $4 card activation for dollar dominated and N2,000 or more for the Naira-denominated card.

In essence, the relevant UBA prepaid card issuance fees must be paid when applying for the card.

How To Get the UBA Prepaid Card in Nigeria

To start with, you need to decide if you are going for the Naira or Dollar-denominated card.

With this decision made, follow the prompts below to get your card.

Step 1. Visit any UBA branch with the required documents.

Go with a Passport, Utility bill (like Water or Nepa bill), and an ID card.

Step 2. Request for the “UBA Prepared Dollar Card”

Walk into any UBA bank and request the “UBA Prepared Dollar Card”, and you will be given a form to fill out.

Alternatively, you can download an online form and fill it.

Note: going to the bank is better than filling out an online form.

Step 3. Get the Card in 45 mins to 1:49 hr.

After the form fill out, your card will be printed and you are done.

Pls, remember to tell the “customer support personnel” to print your name on it – as in, do not take a card that your name is not inscribed on it – because you won’t be able to transact with it flawlessly.

So, if they inform you that their printing machine can’t inscribe names for now, just move outs to another UBA branch.

Step 4. Fund the Prepared Card for Activation

The bank card activation fee is $4 only, but it is recommended to fund it with $5 at once for other tiny miscellaneous.

Here, you can decide to buy a physical $5 note from an Aboki and fund it in the banking hall, or contact us and we will fund it for you cheaper than the black-market rate and without going back to the bank.

Also, if the Naira card, go with at least N2,000 to fund and activate the card.

Step 5. Register on the UBA Prepared Dollar Card Service Portal.

The UBA card portal gives you control over the card activities such as viewing card activity, checking the balance on the card, card-to-card transfer, phone number modification, email modification, and more.

Here are the full steps. And after you get the card, here is how to register on the Service Portal/activation.

Step 6. Fund the card and start Transacting

While you can fund the card by buying dollars at the black-market rate from an Aboki (the Bureau de change guys), and taking it to the bank for funding, you can advantageously make use of fnfSwap and get dollar-to-Naira funding at lower funding rates as compared to the black-market rate – a great value for your money.

That is it.

With this card, you are good to sort out your everyday purchases, withdraw from any ATM and make your online payments with your prepaid card.

How Much Does It Cost to Get a UBA Prepaid Card?

The UBA Afri prepared card, be it Naira or Dollar denominated is FREE for both UBA and non-UBA customers. This means you pay nothing to get it.

How to Get the UBA Prepaid Online

If you feel like doing everything online, now go to the UBA Forms library and download and print out the forms you need.

Click here to get the prepaid card online application form.

After filling out the form, you need to take it to the banking hall for officials’ endorsement. Alternatively, call the UBA customer support for submission guidelines.

Click here to contact UBA support.

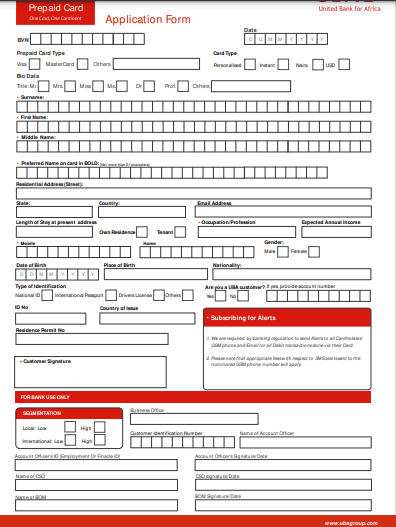

How To Fill the UBA Prepaid Card Application Form

Whether online or at the banking hall, when given the form, follow the prompts below to fill the form. Below is what the form looks like.

- BVN – fill the space given.

- Date – fill in as required.

- Prepare Card Type – tick” Visa”

- Card Type – tick “USD or Naira” – based on the type you prefer.

- Biodata – fill in as required.

- Name – enter your 3 names.

- Preferred Name on the card in BOLD – I recommend you enter your First and Last name.

- Residential Address (Street) – fill

Fill others as duly. And lastly – sign it and hand it over to customer care for endorsement while you wait for your card to be printed in a few minutes.

Read also – [New] How to Withdraw from UBA Dollar Prepaid Card Online/Offline

What is UBA Prepaid Card Client ID?

Now, before you get confused, your Uba prepaid card client ID is the 10 digits at the back of your card.

#1. The 10 digits Client ID acts as your card account number.

#2. The 10 digits Client ID is the account number you fund the card with.

#3. The 10 digits Client ID is the same number used for cardholders’ transfers.

UBA Card Login – GtpSecureCard UBA Log In

With your card gotten and activation complete, you can log into your card service portal and do whatever you want.

But then, the myubaafricard login platform is otherwise called “GtpSecureCard Uba Log In”.

So, GtpSecureCard Uba Log In, myubaafricard login, and “Uba Card Login” are all the same thing/login portal.

To log in, click here to access it.

Next, enter your username and passcode/password you chose during registration/activation on the portal.

When done, click on “Login” and you are done.

We are almost done. Let’s see how to use Uba prepaid card.

The truth is, using the UBA prepaid card varies based on platforms, so, we will tackle it generally.

How To Use UBA Prepaid Card

Step 1. Load your prepared card

If the Naira card, take N2,000 with you and fund the card.

And if USD, you either buy dollars from Bureau de Change guys and take it to the bank or make use of fnfSwap and get your dollar card funded without going to the bank and at a cheaper rate.

Step 2. Pay for online services

Be it on Netflix, Facebook ads, Google Ads, or any card payment services, all you need to do is to enter your card details – the 16 digits in front of your prepared card, your name as on the card, and CVV – the 3 digits at the back of your card, and lastly, confirm the transaction.

Step 3. Confirm Transaction via UBA Transfer code

As soon as you initiate card transactions, a code will be sent via SMS to your phone number. See a sample below.

You’ve initiated a fund transfer request. Here’s your transfer code: 123456

When you get it, enter the same and your online transaction will be confirmed.

If it were a Naira card, this will be based on the exchange rate, and if the dollar, it will be based on the dollar price.

For instance, if the transaction was in Naira, you will be charged according to the UBA exchange rate, and if it was in dollars, say, $60, you will be charged $60 as well.

That is all on how to use Uba prepaid card.

How To Check UBA Prepaid Card Balance

Step 1. Log into your card portal.

Step 2. Look up and you will see your Prepaid Card Balance shown. See below.

Terms of using the UBA Prepaid Card

#1. You can use the card for withdrawal of cash from cash machines (ATMs) and/or to make payments for goods and/or services.

#2. The card is a UBA card, and so, any illegal usage will get it blocked.

As in, the card must not be used for any unlawful transactions including the purchase of goods and/or services prohibited by the laws of the Federal Republic of Nigeria.

#3. In terms of FOREX, UBA will convert all overseas transactions into US Dollar currency using the prevailing exchange rate as determined by the Bank.

Also, a percentage commission as determined by the Bank from time to time shall be charged on the amount of the transaction.

#4. You should treat your Prepaid Card like cash.

That is, if it is lost or stolen, you may lose some or all of your money on your card, in the same way as if you lost cash in your wallet or purse. As a result, you must keep your card safe and not let anyone else use it.

#5. For fees, you shall be charged fees by the Bank, in accordance with the Bank’s schedule of fees and charges regarding your Prepaid Card.

FAQs About UBA Prepaid Card

How can I get my prepared Card Statement of Account?

First of all, login to your card portal, next, you enter your client ID as the username and Web Code on your pin mailer as your passcode for first timer.

With everything set up, log in, enter the duration of the statement, and export to PDF or CSV as you want.

How do I change my Card Online PIN or Password?

Simply log in to your prepaid card profile, and enter your client ID as the username and Web Code on your pin mailer as your passcode for first timer.

With everything set up, go ahead and validate your email address and enter the code sent to the mobile number. Click on Change PIN or Password.

How do I log in to my prepared card profile?

Go to the gtpsecurecard uba page. Visit here.

In summary of the UBA visa Africard Review.

With the UBA prepaid card, you can make a purchase or bill payment anywhere you are, sort out your everyday purchases, withdraw from any ATM and make your online payments with your prepaid card – based on the denomination you are using – Naira or Dollar.

But if you ask me, I recommend the dollar card denominated for versatility.

With the dollar-denominated, you can withdraw from PayPal to it – you can see the steps here, transfer from one cardholder to another, and more as available in your service portal.

And lastly, you can easily pay for digital ads like Facebook, Google ads, Web hosting, Domain, Netflix, and more.

Have any questions? If yes, drop them below, and if not, next step guides are coming such as:

-

How to withdraw from PayPal with UBA Prepaid dollar card

-

How to Link UBA Prepaid Card to PayPal Account

-

Best ways to fund Uba prepaid cards, and more.

Want to Load or Swap UBA Prepaid Card Funds? Get Done Instantly

Load AfriCard

If you want to fund your card, click here to Load with fnfSwap [lesser than the Black-Market Rate]

Swap Funds

Request to Swap AfriCard Funds online & get Naira in less than 15 minutes.

About fnfSwap

FnfSwap helps Swap Freelance PayPal Sourced Funds for Naira. Fund & Swap UBA Dollar AfriCard, Fund Wallet Africa & Wise Balance, and Swap USDT for Naira.

They fund AfriCard at rates and exchange at a high best rate as well. FnfSwap is committed to helping freelancers/digital experts transact flawlessly.

Learn what others are saying about us on Trustpilot, or visit us at https://fnfswap.com.ng/ . If you have any questions, send us an email at [email protected] | [email protected]

![[New] 72ig Course Review by Toyin Omotoso, Price [₦142k Discount Info] 72IG Implementation Training Program](https://isuawealthyplace.com/wp-content/uploads/2020/05/72IG-Implementation-Training-Program-370x350.png)

Thank you for your article on How to Use Uba Prepaid Card Review & Best Types 2022

Thank you, Chris.

This blogpost saved me the hassle of creating and login to my uba prepaid card

Thank you, Emi and welcome.

please can I get more information about the naira card of Africard? thanks

Kindly write to me – check our contact page.